Business Management | Resources

Sourcing In India, China And Vietnam: Challenges And Opportunities

Feb 01, 2022 | Konark Ogra

An introduction on key factors before you decide on sourcing from south east asia.

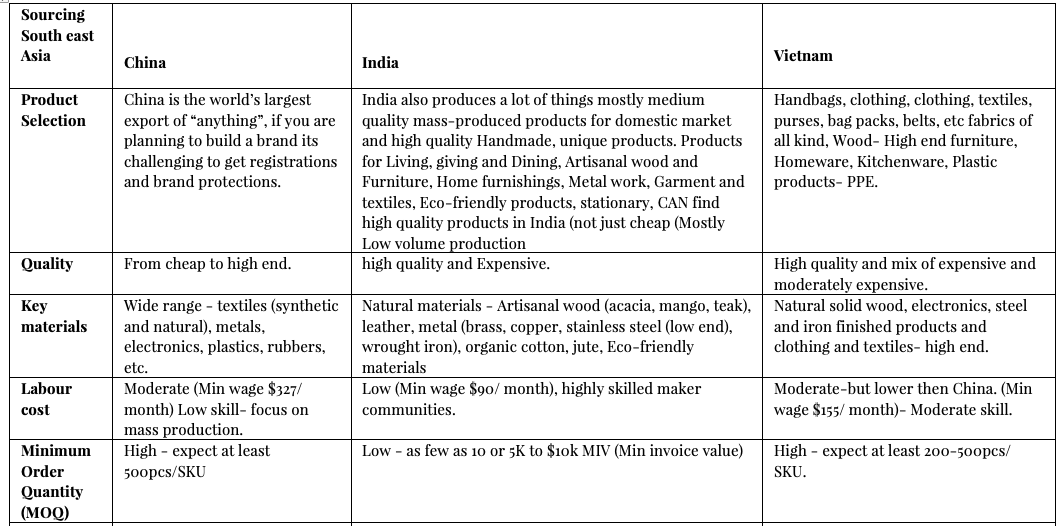

An introduction on key factors before you decide on sourcing from south east asia. 1. Product Selection

- China is the world’s largest export of “anything”, if you are planning to build a brand it's challenging to get registrations and brand protections.

- India also produces a lot of things mostly medium quality mass-produced products for the domestic market and high-quality Handmade, unique products. Products for Living, giving and Dining, Artisanal wood, and Furniture, Home furnishings, Metalwork, Garment and textiles, Eco-friendly products, stationery, can find high-quality products in India (not just cheap (Mostly Low volume production)

- Vietnam produces Handbags, clothing, clothing, textiles, purses, bag packs, belts, etc fabrics of all kinds, Wood- High-end furniture, Homeware, Kitchenware, Plastic products- PPE.

2. Quality

- China: From cheap to high end.

- India: High quality and Expensive.

- Vietnam: High quality and mix of expensive and moderately expensive.

3. Key materials

- China: Wide range - textiles (synthetic and natural), metals, electronics, plastics, rubbers, etc.

- India: Natural materials - Artisanal wood (acacia, mango, teak), leather, metal (brass, copper, stainless steel (low end), wrought iron), organic cotton, jute, Eco-friendly materials

- Vietnam: Natural solid wood, electronics, steel and iron finished products and clothing and textiles- high end.

4. Labour cost

- China: Moderate (Min wage $327/ month) Low skill- focus on mass production.

- India: Low (Min wage $90/ month), highly skilled maker communities.

- Vietnam: Moderate-but lower then China. (Min wage $155/ month)- Moderate skill.

5. Minimum Order Quantity (MOQ)

- China: High - expect at least 500pcs/SKU

- India: Low - as few as 10 or 5K to $10k MIV (Min invoice value)

- Vietnam: High - expect at least 200-500pcs/ SKU.

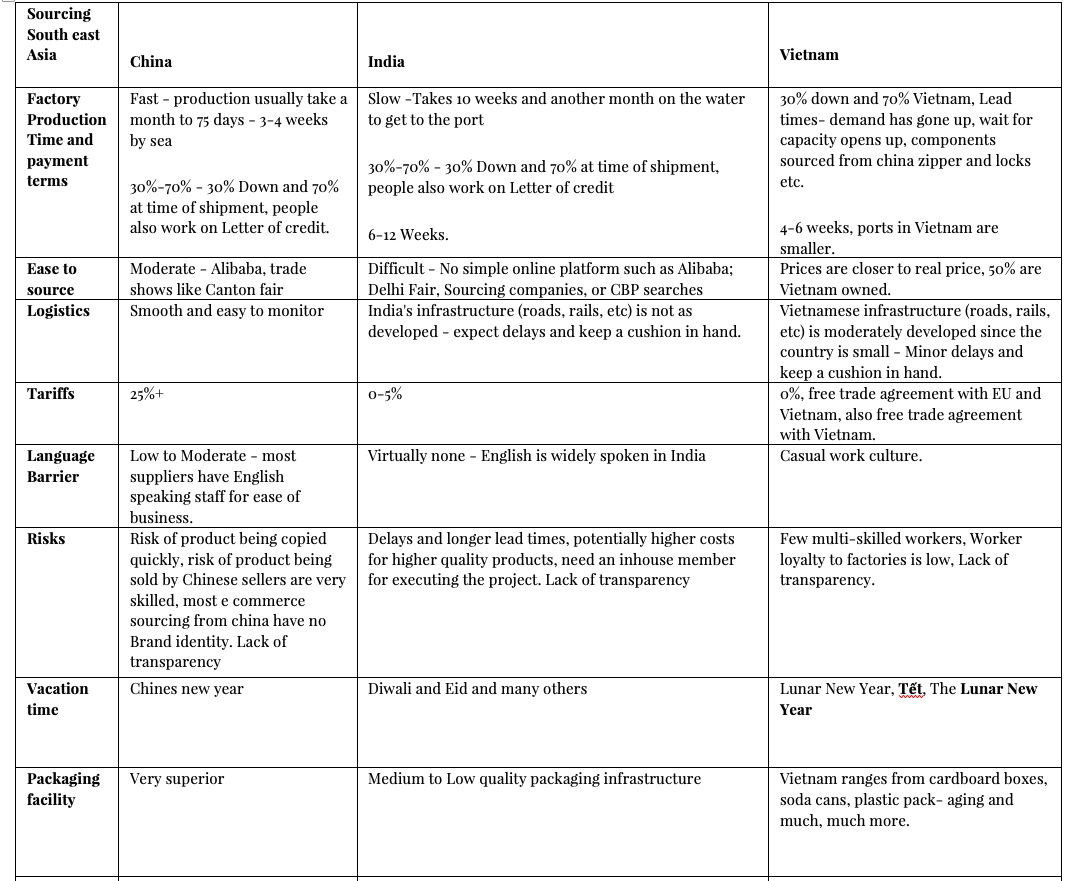

6. Factory Production Time and payment terms

- China: Fast - production usually take a month to 75 days - 3-4 weeks by sea 30%-70% - 30% Down and 70% at time of shipment, people also work on Letter of credit.

- India: Slow -Takes 10 weeks and another month on the water to get to the port 30%-70% - 30% Down and 70% at time of shipment, people also work on Letter of credit6-12 Weeks. 30% down and 70%

- Vietnam: Lead times- demand has gone up, wait for capacity opens up, components sourced from china zipper and locks etc. 4-6 weeks, ports in Vietnam are smaller.

7. Ease of source

- China: Moderate - Alibaba, trade shows like Canton fair

- India: Difficult - No simple online platform such as Alibaba; Delhi Fair, Sourcing companies, or CBP searches

- Vietnam: Prices are closer to real price, 50% are Vietnam owned.

8. Logistics

- China: Smooth and easy to monitor

- India: India's infrastructure (roads, rails, etc) is not as developed - expect delays and keep a cushion in hand.

- Vietnam: infrastructure (roads, rails, etc) is moderately developed since the country is small - Minor delays and keep a cushion in hand.

9. Tariffs

- China: 25%+

- India: 0-5%

- Vietnam: 0%, free trade agreement with the EU and Vietnam, also free trade agreement with Vietnam.

10. Language Barrier

- China: Low to Moderate - most suppliers have English speaking staff for ease of business.

- India: Virtually none - English is widely spoken in India

- Vietnam:Casual work culture.

11. Risks

- China: Risk of the product being copied quickly, risk of the product being sold by Chinese sellers are very skilled, most e-commerce sourcing from china has no Brand identity. Lack of transparency

- India: Delays and longer lead times, potentially higher costs for higher quality products, need an inhouse member for executing the project. Lack of transparency

- Vietnam: Few multi-skilled workers, Worker loyalty to factories is low, Lack of transparency.

12. Vacation time

- China: Chinese new year

- India: Diwali and Eid and many others

- Vietnam: Lunar New Year, Tết, The Lunar New Year

13. Packaging facility

- China: Very superior

- India: Medium to Low-quality packaging infrastructure

- Vietnam: Quality is great and have everything from cardboard boxes, soda cans, plastic packaging, and much, much more.

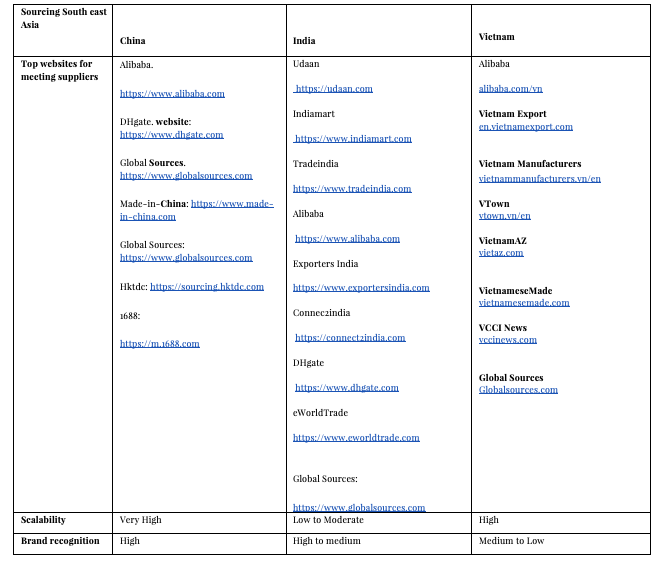

14. Top websites for meeting suppliers

China:

- Alibaba. https://www.alibaba.com

- DHgate. website: https://www.dhgate.com

- Global Sources. https://www.globalsources.com

- Made-in-China: https://www.made-in-china.com

- DHgate: https://www.dhgate.com

- GlobalSources: https://www.globalsources.com

- Hktdc: https://sourcing.hktdc.com

- 1688: https://m.1688.com

India:

- Indiamart: https://www.indiamart.com

- Tradeindia: https://www.tradeindia.com

- Alibaba: https://www.alibaba.com

- ExportersIndia : https://www.exportersindia.com

- Connec2india: https://connect2india.com

- DHgate: https://www.dhgate.com

- eWorldTrade : https://www.eworldtrade.com

- Global Sources: https://www.globalsources.com

Vietnam:

- Alibaba: alibaba.com/vn

- Vietnam Export: en.vietnamexport.com

- Vietnam Manufacturers: vietnammanufacturers.vn/en

- VTown : vtown.vn/en

- VietnamAZ : vietaz.com

- VietnameseMade :vietnamesemade.com

- VCCI News : vccinews.com

- Global Sources : Globalsources.com

15. Scalability and Flexibility

- China: Very High but not flexible.

- India: Low to Moderate, highly flexible

- High: Very High and moderatly flexible.

16. Brand recognition

- China: Very High

- India: High and oppurtunity for great story telling

- Vietnam:High

Fig1: Table of comparison for sourcing from China, India, and Vietnam

Fig1: Table of comparison for sourcing from China, India, and Vietnam Recommended

Community | People

Craft-based training is revolutionizing rural India by equipping artisans, especially women, with practical, income-generating skills like crochet and macramé. This blog explores how Rural Handmade’s people-first training model empowers communities, nurtures entrepreneurship, and creates sustainable livelihoods, offering a replicable roadmap for NGOs, CSR teams, and government-led initiatives.

Community | People

India’s Geographical Indications (GI) framework safeguards unique heritage crafts tied to their place of origin. This blog explores the transformative potential of GI protection in Rajasthan, particularly in Barmer, where vibrant but underrecognized crafts like appliqué, block printing, and stone carving can gain global identity, economic upliftment, and cultural preservation.

Sustainability | Impact

This report presents a comparative Life Cycle Assessment (LCA) of three textile fibres widely used or produced in Nepal: cotton, silk, and hemp. The LCA covers the cradle-to-grave carbon footprint of each fibre, identifying emission hotspots and potential sustainability trade-offs.